In the world of business operations, Net Invoiced Quantity NAV plays a crucial role in financial and inventory management. Whether you run a small business or manage a large enterprise, understanding this term and its implications is essential for accurate reporting and decision-making. This article will delve into the concept of net invoiced quantity NAV, its significance, and how it integrates with business processes to streamline operations.

What is Net Invoiced Quantity NAV?

Net invoiced quantity (NAV) refers to the adjusted quantity of goods or services a company invoices to a customer after accounting for returns, discounts, or allowances. This value reflects the actual amount billed and plays a critical role in financial records and inventory systems. It ensures that the invoiced quantity accurately represents what the customer received and accepted.

In Microsoft Dynamics NAV, a popular enterprise resource planning (ERP) system, this concept is widely used to maintain accurate financial and operational data. The system automatically calculates the net invoiced quantity by accounting for various factors such as returns and adjustments, providing businesses with reliable metrics for analysis.

Importance of Net Invoiced Quantity NAV

Understanding net invoiced quantity is vital for several reasons. It ensures businesses accurately recognize revenue by recording income only for goods or services they have delivered and the customer has accepted.

. This accuracy is critical for maintaining trustworthy financial statements.

It also helps in inventory management by tracking the actual quantity of goods sold. This insight allows businesses to better plan inventory replenishments, avoid stockouts, and minimize excess stock. Additionally, it strengthens customer relationships by ensuring transparency in billing and reducing disputes related to invoiced amounts.

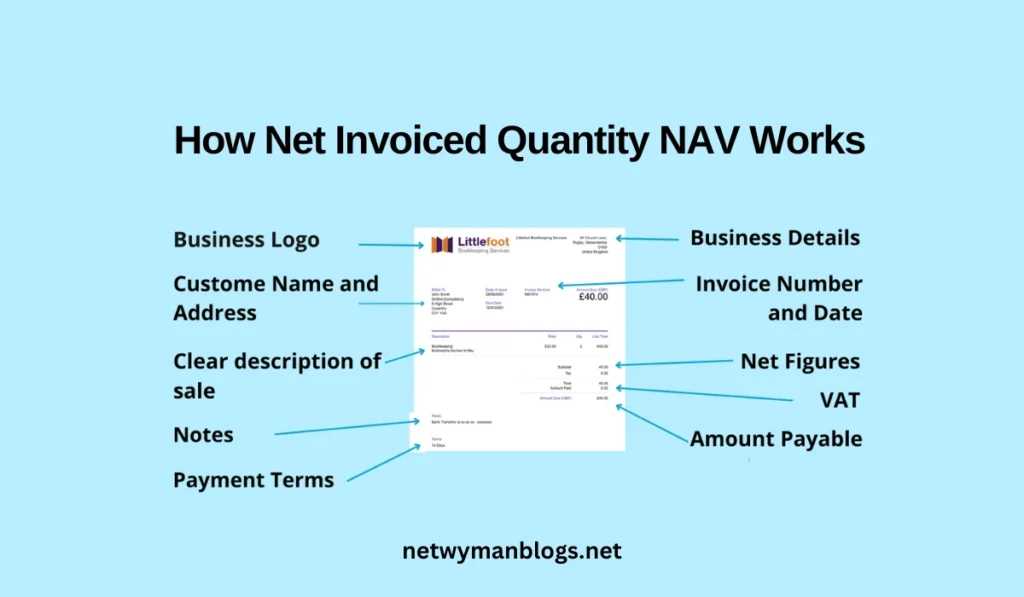

How Net Invoiced Quantity NAV Works

In practice, net invoiced quantity NAV is calculated by taking the gross quantity of goods or services and subtracting any adjustments. These adjustments may include:

- Returns of defective or unwanted goods.

- Discounts offered during the sale.

- Allowances for damaged or incomplete shipments.

For example, when a company ships 1,000 units of a product to a customer and the customer returns 100 defective units, the company records a net invoiced quantity of 900 units. This adjustment ensures the invoiced amount accurately reflects the financial records.

Read more: Iamrestaurant com quotes

Integration with Microsoft Dynamics NAV

Microsoft Dynamics NAV simplifies the calculation and tracking of net invoiced quantity NAV. The system integrates data from various modules, such as sales, inventory, and financials, to automatically update invoiced quantities. This integration ensures real-time visibility into business operations and minimizes manual errors.

For instance, when a company processes a sales order, the system captures the gross quantity, accounts for any returns or adjustments, and calculates the net invoiced quantity. The financial and inventory records then reflect this value, ensuring a seamless flow of information across departments.

Benefits of Using Net Invoiced Quantity

The use of net invoiced offers numerous benefits to businesses. It enhances operational efficiency by automating calculations and reducing manual effort. This automation not only saves time but also minimizes the risk of errors, ensuring accurate reporting.

It also supports better decision-making by providing reliable data on sales and inventory. With accurate information on invoiced quantities, businesses can analyze sales trends, forecast demand, and optimize inventory levels. Furthermore, it improves compliance with accounting standards by ensuring that revenue is recognized correctly.

Read more: About technology and New strategies regarding blogging at Netwyman Blogs Website.

Challenges in Managing Net Invoiced Quantity

Despite its advantages, managing net invoiced quantity NAV can be challenging, especially for businesses with complex operations. Common challenges include handling large volumes of data, managing returns and adjustments, and ensuring data consistency across systems.

To overcome these challenges, businesses can leverage the robust features of Microsoft Dynamics NAV. The system’s automated processes and real-time updates ensure that invoiced quantities are accurately tracked, even in complex scenarios. Additionally, regular training and process reviews can help employees effectively manage invoiced quantities.

Practical Example of Net Invoiced Quantity NAV

Let’s consider a practical example to illustrate the concept of net invoiced quantity. A company sells 500 units of a product to a customer at $10 per unit. During the delivery, 50 units are found to be defective and returned by the customer. The company also offers a 10% discount on the remaining units as a goodwill gesture.

Here is how the net invoiced quantity and amount are calculated:

| Item | Quantity | Price per Unit ($) | Total Amount ($) |

|---|---|---|---|

| Gross Quantity | 500 | 10 | 5,000 |

| Returned Quantity | 50 | – | -500 |

| Discount (10%) | 450 | 1 | -450 |

| Net Invoiced Amount | 450 | 10 | 4,050 |

This example shows how businesses factor adjustments into the net invoiced quantity and amount, ensuring accurate billing.

Applications of Net Invoiced Quantity NAV

The net invoiced quantity NAV is used in several critical areas of business operations:

- Inventory Management: Helps track the accurate quantity of products in stock.

- Financial Reporting: Ensures that invoices match delivered quantities, reducing errors in accounting.

- Supplier Management: Monitors supplier performance by comparing invoiced versus delivered quantities.

- Customer Relations: Enhances transparency with customers by ensuring accurate billing.

By leveraging net invoiced quantit, companies can streamline their operations, improve customer satisfaction, and avoid costly errors in invoicing and inventory management.

Read more: Ecryptobit com ethereum

Frequently Asked Questions

What is the difference between gross and net invoiced quantity?

Gross invoiced quantity is the total quantity before any adjustments. Net invoiced quantity accounts for returns, discounts, and allowances.

Why is net invoiced quantity important in accounting?

It ensures revenue is recognized accurately, reflecting the actual quantity delivered and accepted by the customer.

Can Microsoft Dynamics NAV handle complex invoicing scenarios?

Yes, the system is designed to manage complex scenarios, including partial shipments, returns, and discounts, with ease.

How can businesses improve the accuracy of net invoiced quantities?

Businesses can use automated systems like Dynamics NAV, conduct regular audits, and provide training to staff.

Conclusion

In conclusion, net invoiced quantity NAV is a fundamental concept in business operations, providing accurate insights into invoiced quantities and supporting efficient inventory and financial management. By leveraging tools like Microsoft Dynamics NAV, businesses can streamline the calculation and tracking of invoiced quantities, ensuring accuracy and compliance.

Understanding and effectively managing net invoiced quantity NAV not only enhances operational efficiency but also supports better decision-making, ultimately contributing to the success of the organization.