Cryptocurrencies have revolutionized the financial market, creating opportunities for investors worldwide. However, they are also prone to rapid price swings, leading to Crypto Bubbles that inflate quickly and burst unexpectedly. Understanding these bubbles is crucial to making informed investment decisions and safeguarding your assets.

In this article, we will explore crypto bubbles, how they form, key indicators, famous examples, and strategies to protect your investments. If you have ever wondered why Bitcoin or meme coins suddenly rise and fall, this article will provide the clarity you need.

What Are Crypto Bubbles?

A crypto bubble forms when the price of a cryptocurrency surges far beyond its intrinsic value due to speculation and investor hype. Investors buy into the asset hoping for quick profits, pushing prices higher. However, when confidence fades, the bubble bursts, and prices crash dramatically.

Unlike traditional financial markets, where regulations help control speculation, the crypto market is largely unregulated. This lack of control increases the chances of crypto bubbles, making it essential for investors to recognize them early.

Key Indicators of a Crypto Bubble

To identify whether a cryptocurrency is in a bubble, investors should analyze these key indicators:

| Indicator | Description |

|---|---|

| Rapid Price Surge | Prices increase exponentially in a short period without fundamental improvements. |

| Excessive Media Hype | Social media, news outlets, and influencers heavily promote a coin, increasing public interest. |

| FOMO (Fear of Missing Out) | Investors rush to buy out of fear of missing profits, even without understanding the technology. |

| Lack of Utility | The cryptocurrency has no real-world use cases or technological advancements but continues to rise. |

| Pump-and-Dump Schemes | Whales (large investors) manipulate the market by artificially inflating prices and then selling off. |

| High Retail Investor Activity | Many inexperienced investors enter the market, leading to irrational price movements. |

| Market Euphoria | Investors believe prices will keep rising indefinitely, ignoring warning signs. |

Recognizing these warning signs can help traders avoid losses before a bubble bursts.

Read more: Bettermods net

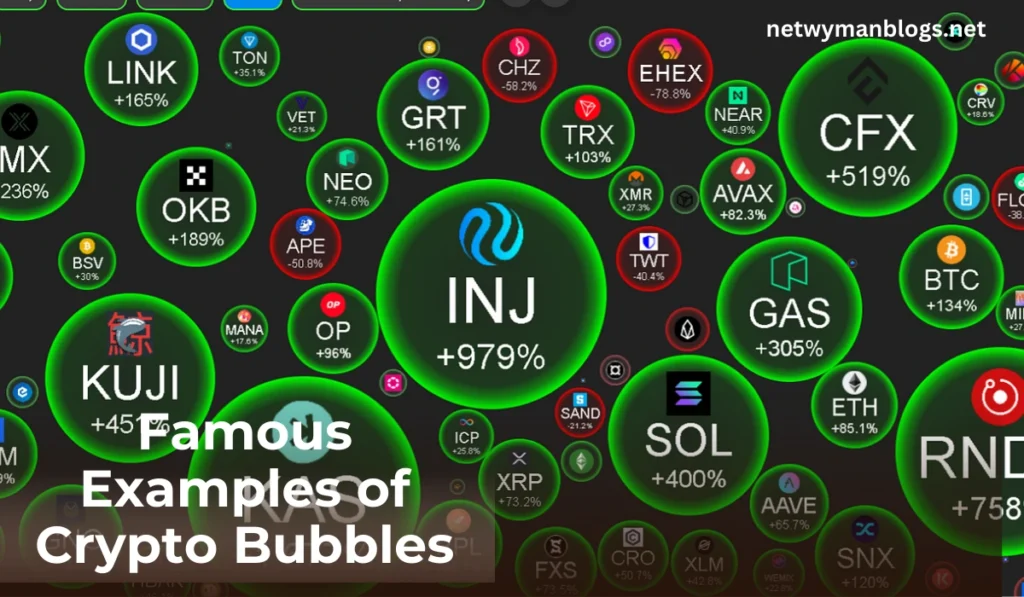

Famous Examples of Crypto Bubbles

The cryptocurrency market has seen multiple bubbles over the years. Let’s examine some of the most significant ones:

1. Bitcoin’s 2017 Bubble

Bitcoin saw an unprecedented rise from $1,000 in January 2017 to nearly $20,000 in December 2017. However, it wasn’t based on actual adoption but rather speculative buying. The crypto bubble burst in 2018, causing Bitcoin to fall to $3,000 within months.

2. The ICO Bubble (2017-2018)

The Initial Coin Offering (ICO) boom saw hundreds of new tokens launched, promising revolutionary blockchain solutions. Investors poured billions into projects with no real value. Eventually, most of these tokens collapsed when the market corrected, leading to a massive crash.

3. Meme Coin Mania (2021)

Meme coins like Dogecoin and Shiba Inu skyrocketed in 2021 due to celebrity endorsements and social media hype. Dogecoin surged over 12,000%, driven by tweets from Elon Musk. However, once the hype faded, prices dropped significantly, leaving late investors with heavy losses.

4. NFT Bubble (2021-2022)

Non-fungible tokens (NFTs) saw an explosive rise, with digital art pieces selling for millions. However, many NFTs lost over 80% of their value as the hype died down, proving that speculation drove the market rather than genuine demand.

Role of Market Sentiment in Crypto Bubbles

Market sentiment plays a crucial role in crypto bubbles. When sentiment is overly optimistic, prices rise rapidly. However, when fear and doubt creep in, prices collapse just as quickly. Investors need to differentiate between hype-driven growth and genuine technological advancements.

How Sentiment Influences the Market

- Positive Sentiment: Influencers, media, and financial analysts promote a coin, attracting buyers.

- Market Euphoria: Prices rise as everyone wants to invest.

- Fear and Panic: A sudden news event (e.g., regulations, exchange hacks) leads to a sell-off.

- Bubble Burst: The price drops rapidly, wiping out most of the gains.

Understanding sentiment analysis tools can help traders predict market movements before a bubble bursts.

How to Protect Your Investments from Crypto Bubbles

While crypto bubbles are unpredictable, there are strategies to minimize risks and safeguard your investments.

1. Diversify Your Portfolio

Investing in multiple cryptocurrencies and traditional assets like stocks and bonds reduces exposure to sudden market crashes. If one asset collapses, others might offset losses.

2. Use Stop-Loss Orders

Setting stop-loss orders ensures automatic selling if the price falls below a certain level. This prevents major losses in case of a market downturn.

3. Avoid Emotional Trading

Many investors make impulsive decisions based on hype and fear. Sticking to a solid strategy and avoiding emotional trading is key to long-term success.

4. Analyze Market Fundamentals

Before investing, check whether the cryptocurrency has real-world utility, active development, and strong adoption. Avoid coins driven solely by speculation.

5. Take Profits Gradually

Instead of waiting for the absolute peak, take profits at different levels. This ensures you secure gains even if the market suddenly crashes.

Spotting Bubble Peaks with Market Data

Advanced market analysis tools like heatmaps and liquidity charts help traders identify bubble peaks. Bookmap is a tool that provides real-time order flow analysis, helping investors spot key liquidity zones before a bubble bursts.

Read more: Emergingtechs net

How Market Data Helps Spot Bubbles

| Data Tool | How It Helps |

|---|---|

| Real-Time Heatmaps | Shows where large buy and sell orders are placed. |

| Order Book Analysis | Identifies sudden shifts in buy/sell pressure. |

| Volume Indicators | Highlights unusual trading activity signaling a bubble peak. |

| Sentiment Analysis | Detects social media trends to gauge hype levels. |

Using these tools allows investors to make informed decisions rather than relying on speculation.

Frequently Asked Questions (FAQs)

What is the difference between a crypto bubble and a bull run?

A crypto bubble is driven by speculation and bursts suddenly, while a bull run is a long-term market uptrend based on solid fundamentals.

How can I tell if a cryptocurrency is in a bubble?

Signs include rapid price increases, excessive media hype, and high retail investor activity without fundamental growth.

Is Bitcoin always in a bubble?

No, Bitcoin has experienced several bubbles, but it has also established itself as a long-term asset with increasing institutional adoption.

Can I still profit from a crypto bubble?

Yes, if you enter early and exit before the crash, you can make profit. However, timing the market is very risky.

Conclusion

Crypto bubbles are an inevitable part of the cryptocurrency market, driven by speculation, hype, and investor psychology. While some investors make significant profits, many suffer losses when the bubbles burst. Understanding market trends, sentiment analysis, and risk management is essential for making safe investment choices.

Investors should focus on long-term utility rather than short-term gains. By using market data tools, diversifying portfolios, and avoiding emotional trading, one can navigate the crypto market more safely.

Staying informed and applying smart investment strategies will help traders avoid getting caught in the next crypto bubble.